It appears you don't have a PDF plugin for this browser. Please use the link below to download 2019-federal-1040-schedule-f.pdf, and you can print it directly from your computer.

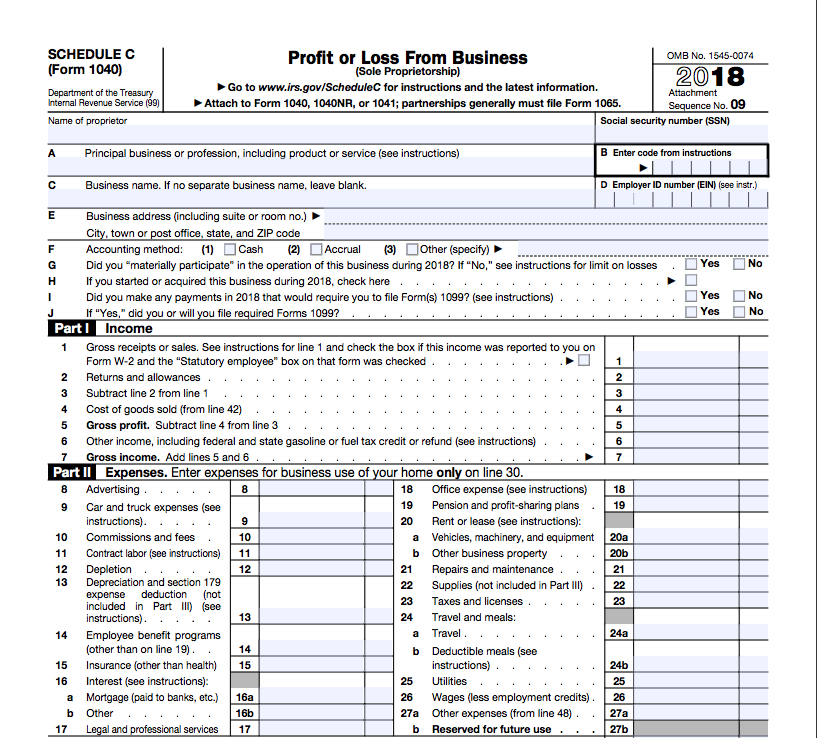

- 2018 Profit And Loss Schedule C Form

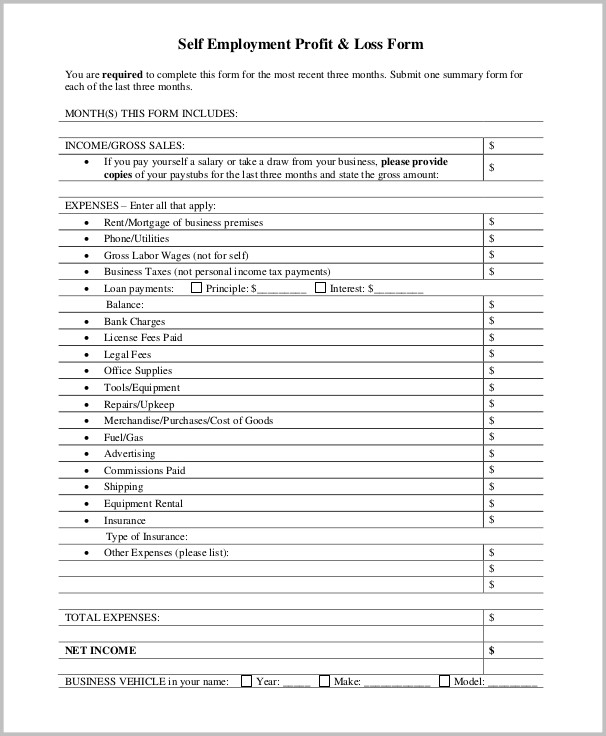

- Download Free Profit Loss Form

- Free Printable Profit Loss Forms

- Free Profit And Loss Template Self Employed

- 2020 Profit And Loss Form

A Profit and Loss Statement Form or Income Statement is a component of Business Financial Statement Forms that outlines the total revenue and total expenses of a company over a given period of time, usually a fiscal year. From its name itself, it helps a company identify if there were any profit or loss during the given period. Profit and loss templates give you the information you need when you need it for peace of mind and transparency. Just plug in revenue and costs to your statement of profit and loss template to calculate your company’s profit by month or by year and the percentage change from a prior period.

More about the Federal 1040 (Schedule F)Individual Income TaxTY 2019

We last updated the Profit or Loss From Farming in January 2020,so this is the latest version of 1040 (Schedule F), fully updated for tax year 2019. You can download or print current or past-year PDFs of 1040 (Schedule F) directly from TaxFormFinder.You can print other Federal tax forms here.

eFile your Federal tax return now

eFiling is easier, faster, and safer than filling out paper tax forms. File your Federal and Federal tax returns online with TurboTax in minutes. FREE for simple returns, with discounts available for TaxFormFinder users!

File Now with TurboTaxRelated Federal Individual Income Tax Forms:

TaxFormFinder has an additional 774 Federal income tax forms that you may need, plus all federal income tax forms.These related forms may also be needed with the Federal 1040 (Schedule F).

| Form Code | Form Name |

|---|---|

| 1040 (Schedule B) | Interest and Ordinary Dividends |

| 1040 (Schedule A) | Itemized Deductions |

| 1040 (Schedule E) | Supplemental Income and Loss |

| 1040 (Schedule SE) | Self-Employment Tax |

| 1040 (Schedule C) | Profit or Loss from Business (Sole Proprietorship) |

| 1040 (Schedule R) | Credit for the Elderly or the DisabledTax Credit |

| 1040 (Schedule EIC) | Earned Income Tax CreditTax Credit |

| 1040 (Schedule 8812) | Child Tax CreditTax Credit |

| 1040 (Schedule D) | Capital Gains and Losses |

| 1040 (Schedule C-EZ) | Net Profit from Business (Sole Proprietorship) |

Form Sources:

The Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later.We last updated Federal 1040 (Schedule F) from the Internal Revenue Service in January 2020.

- Original Form PDF is https://www.irs.gov/pub/irs-pdf/f1040sf.pdf

- Federal Internal Revenue Service at http://www.irs.gov/

About the Individual Income Tax

:max_bytes(150000):strip_icc()/ExxonBS09-30-2018-5c5dc25646e0fb000144215d.jpg)

The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms!

Historical Past-Year Versions of Federal 1040 (Schedule F)

We have a total of nine past-year versions of 1040 (Schedule F) in the TaxFormFinder archives, including for the previous tax year. Download past year versions of this tax form as PDFs here:

2019 1040 (Schedule F)2019 Schedule F (Form 1040 or 1040-SR)

2017 1040 (Schedule F)2017 Schedule F (Form 1040)

2018 Profit And Loss Schedule C Form

2015 1040 (Schedule F)2015 Schedule F (Form 1040)

2012 1040 (Schedule F)2012 Schedule F (Form 1040)

TaxFormFinder Disclaimer:

While we do our best to keep our list of Federal Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. Is the form on this page out-of-date or not working? Please let us know and we will fix it ASAP.

A Profit and Loss Statement Form or Income Statement is a component of Business Financial Statement Forms that outlines the total revenue and total expenses of a company over a given period of time, usually a fiscal year. From its name itself, it helps a company identify if there were any profit or loss during the given period. This way, the company can assess their profitability or their ability to generate income.

Related:

Sample Profit and Loss Statement Form

Example Monthly Profit & Loss Statement Form

Profit and Loss Statement for Homeowners

Free Profit and Loss For Human Services

Parts of a Profit and Loss Statement Form

Download Free Profit Loss Form

- Gross Profit: This is calculated by subtracting the cost of goods sold from the net sales. The net sales includes the revenue from products and / or services sold after the deduction of returns, allowances, discounts, and damaged or missing items. The cost of goods sold comprises the cost of direct labor and materials, any overhead expenses that went into manufacturing the products.

- Operating Income: This is calculated by subtracting the operating expenses from the calculated gross profit. Operating expenses are those that go toward administration costs, like the wages of employees that do not directly have anything to do with manufacturing the product. Other expenses included in this bracket are utilities, marketing, insurance, transportation, and depreciation of assets among others. The resulting value, which is the operating income, is the total income of a company from its normal business functions.

- Non-operating Income: This is the deduction of non-operating expenses from non-operating revenues. These are expenses and revenues that do not have anything to do with the normal functions of the business. Common examples are interest from the sale of investments, and losses from lawsuits and interest paid to lenders.

- Net Income: This is the leftover income after all expenses have been deducted. If it is positive, then there is a profit. If it is negative, then there is loss. The net income is then added to the retained earnings of a company, which can be used to invest in business activities. You may also our other Statement Forms like our Witness Statement Form and Statement of Information Form.

Business Profit and Loss Statement Form in Excel

Fundraiser Profit and Loss Statement Form

Free Printable Profit Loss Forms

Self Employment Profit and Loss Statement Form

Free Profit And Loss Template Self Employed

Schedule C Profit and Loss Statement Form Format

Calculating the net income of your company over a given period of time can allow you to see if you’ve made any profit. This information, along with a cash flow statement, can help you identify areas of improvement for budget cuts to increase your income and decrease expenses. This can be done quarterly and annually for close monitoring, because as a company grows, the revenues grow as well, but the expenses could also be growing at a faster rate. You may also see our Sample Financial Statement Forms for other parts of a Business Financial Statement. This can help you have a more integrated outline of your company’s financial standing.